santa clara county property tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Well return some tax credit estimates.

What You Should Know About Santa Clara County Transfer Tax

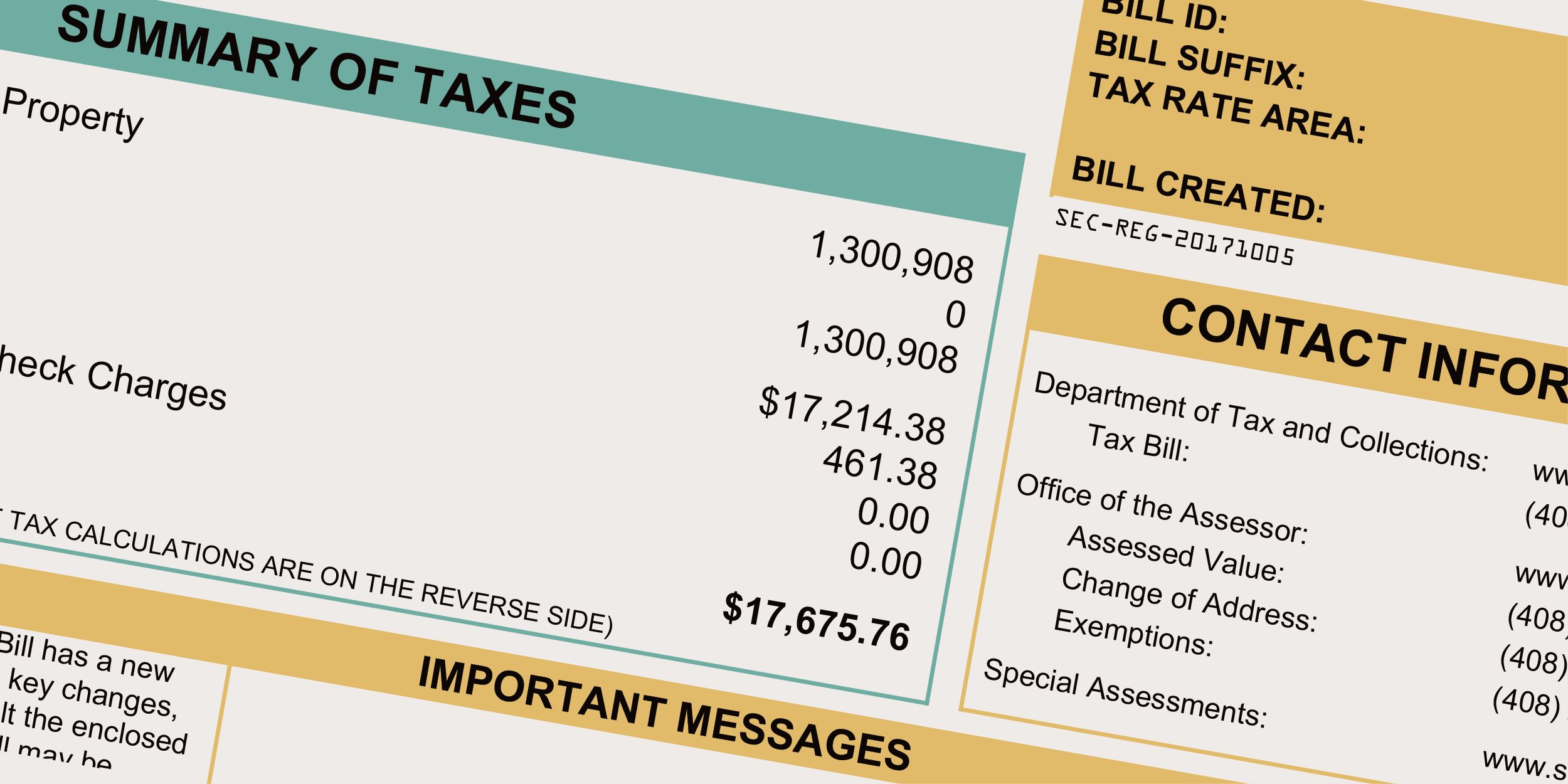

12345678 123-45-678 123-45-678-00 Department of Tax and Collections.

. 100000 5000000. Select your county and enter income and family information below. Fill out the tax credit calculator.

Tax Rate Book Archive. The County of Santa Clara assumes no responsibility arising from use of this information. Send us an Email.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Santa Clara. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. Nevertheless some information may be out of date or may not be accurate. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the.

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. The Santa Clara County Sales Tax is collected by the merchant on all. A Baird Driskell Community Planning project built and managed by Electricbaby.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Learn more about tax credits. Please visit our State of Emergency Tax Relief page for additional information.

The Transfer Band Calculator calculates the percentage difference between classifications. Use our Prop 19 Calculator to see how your Property Tax Base would change if you sold your current home and bought a new home in California. San Jose California 95110.

Property used continuously by the child or grandchild as a primary home or property held as a family farm. Get your tax credit estimate. Narrows the Assessed Value that can be transferred to two kinds of inherited property.

Current personnel rules and Memoranda of Understandings allow qualified employees in classified positions to laterally transfer to a higher classification where the salary range is within 10 12 or 15 of their current. This service has been provided to allow easy access and a visual display of County Assessment information. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

Enter Property Address this is not your billing address. Welcome to the TransferExcise Tax Calculator. County of Santa Clara.

Enter Property Parcel Number APN. What is the assessed value of the home in. Please contact the local office nearest you.

Typical costs to hire someone for this are. Denotes required field. Compilation of Tax Rates and Information.

Tax Base of Current Home. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Ad Find Santa Clara County Online Property Taxes Info From 2022.

Prop 19 Calculator Slider. A reasonable effort has been made to ensure the accuracy of the data provided. For the next step select an option to file your taxes to receive your eligible tax credits.

408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located. File for free and get money back. Monday Aug 15 2022 534 PM PST.

Additional Dwelling Unit Calculator. For comparison the median home value in Santa Clara County is 70100000. Get Record Information From 2022 About Any County Property.

Managing a second unit means finding a tenant and doing repairs as necessary. Learn all about Santa Clara County real estate tax. FY2020-21 PDF 150 MB.

For questions about filing extensions tax relief. Property Information Property State. Starting February 16 2021 Proposition 19 narrows substantially the property tax benefits for inherited properties.

FY2019-20 PDF 198 MB. Property Tax Rate Book Property Tax Rate Book. The Santa Clara County California sales tax is 900 consisting of 600 California state sales tax and 300 Santa Clara County local sales taxesThe local sales tax consists of a 025 county sales tax and a 275 special district sales tax used to fund transportation districts local attractions etc.

File on my. Located in northern California the Official website of the County of Santa Clara California providing useful information and valuable resources to County residents. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Property taxes are levied on land improvements and business personal property.

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

New Employees Learning Employee Development County Of Santa Clara

What You Should Know About Santa Clara County Transfer Tax

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Why Buy Now Lennar House Styles New Homes

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News